A lawyer for the U.S. Virgin Islands said on Thursday that JPMorgan Chase told U.S. authorities it processed more than $1 billion for Jeffrey Epstein over the course of 16 years.

Following Mr. Epstein’s death in 2019, JPMorgan reported its transactions with the convicted sex offender as suspicious to the U.S. Treasury Department, said Mimi Liu, a lawyer for the Virgin Islands territory, at a hearing concerning its lawsuit against the largest U.S. bank.

The bank’s disclosures to the Treasury have not been made public. A JPMorgan spokesperson declined a Reuters request to comment on the matter.

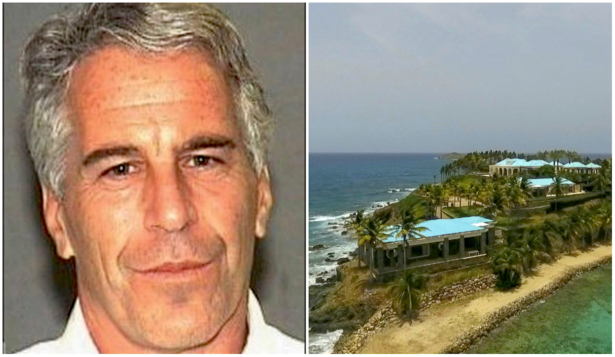

Mr. Epstein was a JPMorgan client from 1998 to 2013 when the bank fired him. The disgraced financier was registered as a sex offender in Florida in 2008 and in 2011 as a “level three” sex offender in New York—a lifelong designation.

Epstein had been awaiting trial on sex trafficking charges when he was found dead in his cell on Aug. 10, 2019.

His death was ruled a suicide, though suspicious circumstances surrounding his death—such as the sudden departure of his cellmate and two surveillance cameras malfunctioning—gave rise to much speculation questioning the official narrative.

The U.S. Virgin Islands, where Mr. Epstein owned two private islands, is suing JPMorgan for at least $190 million and likely much more. They allege the bank ignored red flags that Mr. Epstein was running a sex trafficking operation because he was a lucrative client.

“Over more than a decade, JPMorgan clearly knew it was not complying with federal regulations in regard to Epstein-related accounts as evidenced by its too-little too-late efforts after Epstein was arrested on federal sex trafficking charges and shortly after his death, when JPMorgan belatedly complied with federal law,” the complaint filed by U.S. Virgin Islands Attorney General Denise George last December read.

“Without the financial institution’s participation, Epstein’s sex trafficking scheme could not have existed.”

JPMorgan Claims Ignorance

JPMorgan has denied any awareness that Mr. Epstein was running a sex trafficking operation and has instead faulted the territory for “actively facilitating” Mr. Epstein by giving him tax incentives and waiving sex offender monitoring requirements.

Ms. Liu mentioned the $1 billion worth of transactions, which had not been previously disclosed, during her argument urging U.S. District Judge Jed Rakoff to agree that the bank participated in Mr. Epstein’s sex trafficking.

The Virgin Islands lawyer argued that no reasonable juror could find that JPMorgan was unaware of the activities of its jet-setting client.

“JPMorgan was a full service bank for Jeffrey Epstein’s sex trafficking,” Ms. Liu said.

Felicia Ellsworth, a lawyer for JPMorgan, said it was not appropriate for the judge to determine the question of the bank’s knowledge ahead of the trial, given that current and former employees have testified that they were unaware of Mr. Epstein’s sex trafficking.

According to Ms. Ellsworth, the bank notified the Treasury Department as early as 2002 about Mr. Epstein’s suspicious transactions and at least five times thereafter.

Ms. Ellsworth also disputed the U.S. Virgin Islands’ claim that JPMorgan obstructed investigations into Mr. Epstein, saying the bank had asked federal authorities about their own probes into their client’s conduct.

That is “the polar opposite of trying to obstruct,” she said.

The trial is scheduled for Oct. 23.

Judge Rakoff said he would decide by the end of September whether to resolve major legal disputes sooner.

In June, the judge preliminarily approved JPMorgan’s $290 million settlement with dozens of women who claim to have been abused by Mr. Epstein, while in May, Deutsche Bank, where Mr. Epstein was a client from 2013 to 2018, agreed to a $75 million settlement with his accusers.

The financier’s former girlfriend, Ghislaine Maxwell, was convicted in December 2021 for aiding in his abuses.

Reuters contributed to this article.