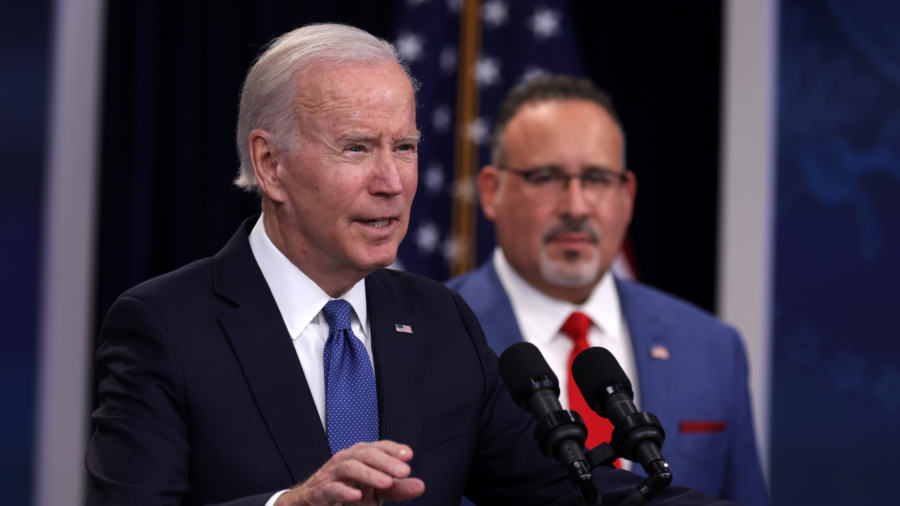

Secretary of Education Miguel Cardona revealed during a recent hearing that the Biden administration is preparing to restart the payment of federal student loan debt that was paused amid the COVID-19 pandemic.

During a May 11 hearing of the Senate Committee on Appropriations, Sen. Katie Britt (R-Ala.) cited remarks by White House press secretary Karine Jean-Pierre who said, regarding the debt ceiling, that “if you buy a car, you are expected to pay the monthly payments. If you buy a home, you are expected to pay the mortgage every month. That is the expectation.”

Britt said she believes “that same logic must apply to student loans,” to which Cardona responded, “We agree and we’re preparing to restart repayment because the emergency period is over, and we’re preparing our borrowers to restart.”

At the beginning of the pandemic in March 2020, student loan payments were suspended by the government. Since then, two presidential administrations have pushed back the end of the suspension period eight times.

In August after rolling out the debt forgiveness plan, the White House announced that repayments would begin Jan. 1, 2023. But this was pushed back after legal challenges to the forgiveness plan reached the Supreme Court.

At present, the Supreme Court is reviewing the orders of a lower court that blocked the Biden administration’s student debt forgiveness plan. Payments are scheduled to resume either 60 days after June 30 or 60 days after the court ruling if the ruling comes before June 30. The court is expected to issue a ruling on the matter this summer.

Back in November, the Department of Education revealed that it had received applications from 26 million individuals for the loan forgiveness program—out of which 16 million were approved. The lower court order prevented the department from considering more applicants as well as forgiving student debt.

Cardona added that the HEROES Act, signed into law by President George W. Bush in January 2002, allows him to “create a waiver for those who are impacted significantly by the pandemic.”

“We recognize after three years of paused payments through two administrations, that the repayment restart is going to be a very important step, and we want to make sure it’s done right,” Cardona said.

“We’re confident that the targeted debt relief will address some of the concerns of some of our borrowers who are struggling right now. But as they re-enter repayment, it’s really important that we provide support for them.”

Issues With Student Loan Forgiveness Plan

According to Biden’s forgiveness scheme, individuals with an annual income of less than $125,000 who have received a Pell Grant while studying could get up to $20,000 of their student loan debt canceled.

Speaking at a March 23 House Committee on Education & the Workforce hearing, Rep. Burgess Owens (R-Utah) warned that Biden’s plan will “mortgage our children’s future.”

“The Biden administration’s proposal is a patchwork attempt that takes a structural problem that will only make worse issues of rising prices and low-quality education,” he said. “This has left millions of Americans with student debt that far exceeds the financial value of their degree.”

In a March 6 commentary in The Epoch Times, Daniel Lacalle, chief economist at hedge fund Tressis, criticized the idea of student loan forgiveness, pointing out that it does nothing to solve the cost of tuition.

Instead, the program may even raise tuition as universities see that the government will subsidize those who take on difficult-to-pay loans, he warned.

“Furthermore, by providing a subsidy to the already indebted, banks may have an incentive to give loans to students with less probability to repay them. It’s likely to create a wave of nonperforming loans predicated on the view that this scheme will be prolonged and even increased,” Lacalle said.

According to a budget model of the proposed student loan forgiveness plan made by the Penn Wharton University of Pennsylvania, the cost of the program could come to anywhere between $333 billion and $361 billion over a 10-year period.

On May 10, the Republican-controlled House Education and the Workforce Committee advanced a resolution aimed at invoking its authority under the Congressional Review Act (CRA) to put an end to Biden’s loan forgiveness program.

From The Epoch Times