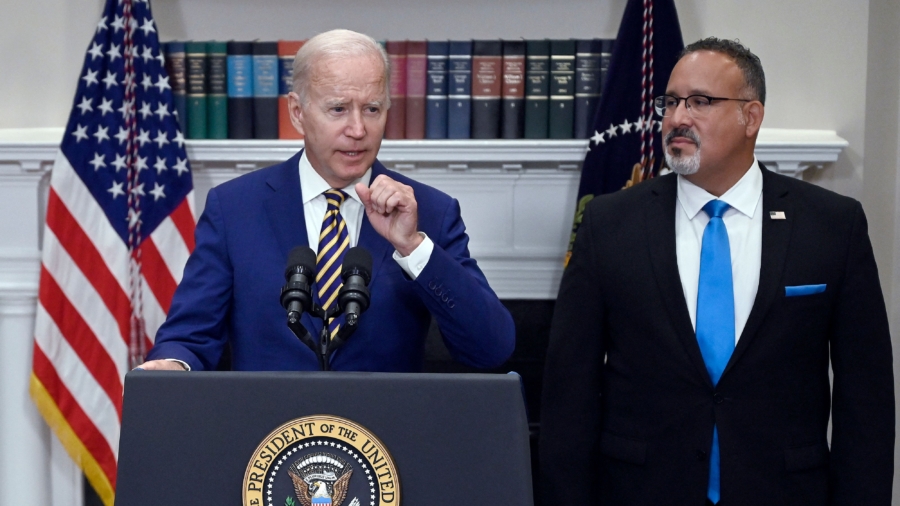

President Joe Biden is continuing to pursue his plan to cancel up to $20,000 in student debt for millions of Americans, and announced more than 16 million Americans have been approved for the program.

In August, Biden announced his plan to cancel up to $20,000 in student debt held by Pell Grant recipients and up to $10,000 in debt held by non-Pell Grant recipients earning less than $125,000 a year. On Friday, the Biden White House provided an update for the plan, saying more than 26 million Americans had either applied or had already been deemed eligible for the debt cancelation program within the first month of its rollout.

The press release provided a state-by-state breakdown of the 26.26 million people who had applied or were automatically deemed eligible for the debt cancellation program. The Biden White House said more than 16.48 million of those borrowers’ applications were fully approved by the Department of Education and sent to loan servicers; but said that student debt relief has not been able to go through as a result of various lawsuits challenging the program.

“Overall, more than 40 million borrowers would qualify for the Biden Administration’s debt relief program,” the White House press release read. “Nearly 90% of the benefits of the relief going to out-of-school borrowers would go to those earning less than $75,000 per year. Millions of those borrowers could be experiencing the benefits of that relief today—were it not for lawsuits brought on by elected officials in some of their own states.”

While Biden touted the benefits student loan borrowers would see if his plan were to go through, opponents of the plan have pointed to its high costs and the need for U.S. taxpayers to cover those costs on behalf of debtors who are not fully paying off the financial obligations to which they agreed.

Lawsuits Block Debt Cancellation

Within days of Biden announcing his debt cancellation program, both Republicans and Democrats criticized the idea. The debt cancellation program also quickly drew several legal challenges and in November, the 8th Circuit Court of Appeals granted an injunction sought by the Republican attorneys general of Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina. The injunction blocked the Biden administration’s debt cancellation program from moving forward.

The Republican attorneys general argued that Biden’s plan cannot proceed because it was not authorized by Congress. They also argued the plan will unfairly burden working-class families, and will further worsen inflation.

Another lawsuit, brought by the Job Creators Network Foundation Legal Action Fund, a small-business advocacy group, argued that the rollout of the debt cancellation plan violated the Administrative Procedure Act’s notice-and-comment procedures by not first giving the public a period to provide input and comment about the program.

The Biden administration has since taken its debt cancellation plan to the U.S. Supreme Court, which kept the plan on hold and agreed to hear the case.

In a January filing, the Biden administration defended the debt cancellation effort, arguing that the Higher Education Relief Opportunities for Students (HEROES) Act of 2003 grants the Department of Education the authority to issue waivers, or other relief, to recipients of student financial aid programs “in connection with a war or other military operation or national emergency.” The national emergency Biden cited was the COVID-19 pandemic.

The Republican attorneys general have argued Biden’s claim that COVID-19 constitutes an emergency is undercut by the fact that he had described plans to cancel student debt as part of his 2020 presidential campaign.

“The Act requires a real connection to a national emergency,” the attorneys general argued. “But the Department’s reliance on the COVID-19 pandemic is a pretext to mask the President’s true goal of fulfilling his campaign promise to erase student loan debt.”

Supreme Court oral arguments for the debt cancellation case are scheduled to begin on Feb. 28.

The Price Tag

Exact totals for the cost of the debt cancellation plan are a matter of debate.

The Biden administration believes the student debt cancellation plan will cost about $30 billion a year over the next 10 years, for a total cost of $300 billion over the next decade.

Other estimates are higher. The National Taxpayers Union Foundation (NTUF) estimated Biden’s plan would actually cost between $386–$405 billion in net costs, leaving the average American with an increased tax burden. Each American taxpayer would bear an extra burden of $2,503 to cover the program.

Another component of Biden’s plan to reform student loans includes lowering the payment monthly requirements and freezing interest accumulations for borrowers that make their loan payments on time. The Biden administration estimates their repayment plan would cost nearly $138 billion over the next decade, while some critics have put the true cost closer to $200 billion.

The conservative Heritage Foundation has also predicted that canceling student debts will lead to colleges increasing their tuition rates because students will have more access to funding.