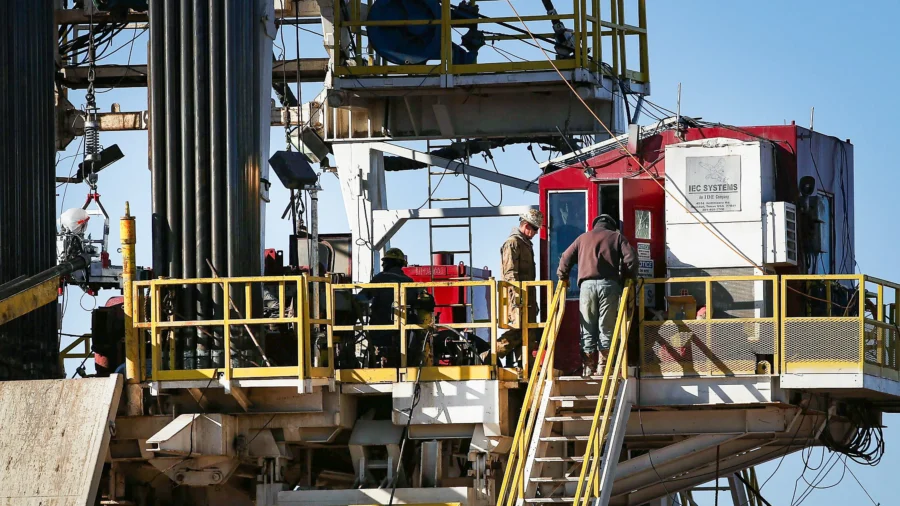

“We will frack, frack, frack, and drill, baby, drill,” former President Donald Trump said in an Oct. 18 speech at a Detroit event.

Now that Trump has secured a second presidential term, market watchers are examining his potential effect on the energy sector, from crude oil and natural gas to solar and wind.

Since declaring his 2024 candidacy, Trump has pledged more oil and gas production, regulatory overhaul, and scaling back the current administration’s green energy subsidies.

The Trump Effect on Oil and Gas

Over the past week, U.S. crude oil prices and natural gas prices have been bumpy.

At the market close on Election Day, Nov. 5, a barrel of West Texas Intermediate (WTI) crude oil, for example, traded at about $72 on the New York Mercantile Exchange. Nearly a week later, oil prices have slumped below $69.

Natural gas prices have seesawed, though they initiated a fierce rally to start the trading week. Prices rallied 9 percent in intraday trading on Nov. 11.

Phil Flynn, an energy strategist at The PRICE Futures Group, says the mixed performances have been fueled by the near-term “psychological impact” of “drill, baby, drill.”

“The U.S. oil and gas industry [can] shake off oppressive regulation and start getting back to the business of producing oil based off supply and demand expectations, not making decisions trying to get guess what the next regulation is going to be,” Flynn told The Epoch Times.

In 2018, the United States became a net oil exporter for the first time in 75 years as the industry produced record amounts of crude, topping 13.1 million barrels per day (bpd) in March 2020. Weekly crude production struggled to rebound in the years following the pandemic. It was in October 2023 that U.S. production climbed above pre-crisis levels, hitting an all-time high of 13.5 million bpd last month.

Estimates for how much extra oil and natural gas will be produced vary.

Flynn estimates that the U.S. could produce an extra 1 million to 2 million barrels bpd in the coming years.

The United States “will retain its role as U.S. oil production grows around 300,000–500,000 barrels per day,” Rob Thummel, the senior portfolio manager at Tortoise Capital Advisors, said in an email to The Epoch Times.” In addition, Thummel projects that natural gas production growth could increase by approximately 30 billion cubic feet per day by 2030.

“We believe that economics, not politics, will prevail. U.S. oil and gas producers will look to maintain capital discipline and to ensure that global oil and natural gas markets remain balanced and avoid being oversupplied,” he said in a note.”

Experts say regulatory uncertainty has been a major source of consternation for the oil and natural gas sector.

In April, for example, the Biden administration approved a rule that would increase the minimum oil and gas lease bond drillers must pay to $150,000 from $10,000. The announcement made it far more expensive for fossil fuel companies to extract oil, gas, and coal from federal lands.

Last year, President Joe Biden temporarily paused U.S. liquefied natural gas (LNG) export approvals, which a federal judge overturned in July 2024. The incoming administration “would immediately reinstate approvals of LNG projects by the Department of Energy,” according to Thummel.

Trump and his team have promised to take action within the Interior Department and other environmental agencies to dismantle energy and environmental regulations. Indeed, boosting fossil fuel production activity on federal lands and waters has been at the core of Trump’s proposed energy policies.

“President Trump will free up the vast stores of liquid gold on America’s public land for energy development,” the Trump campaign said.

Growth prospects, says Warren Patterson, the head of commodities strategy at ING, will likely come from onshore crude production on federal lands, effectively reversing President Biden’s position.

The current administration decreased lease sales on federal lands and bolstered bond and royalty payments for production on federal land.

“If we compare the number of new leases issued during Trump’s first three years in office, it totaled more than 4,000,” Patterson said in a note. “In Biden’s first three years, new lease issuances totalled a little over 1,400. However, lower issuances of leases are having little impact on output so far, with oil production on federal lands growing every year that Biden has been in office.”

But while the president-elect’s administration will adopt friendlier industry policies that could facilitate an acceleration in output, market experts say that prices might be the true driver of production volumes over the next few years.

Based on surveys of producers by the Federal Reserve banks of Dallas and Kansas, oil prices need around $64 per barrel to ensure drilling is profitable.

Adam Ferrari, the CEO of Phoenix Capital Group, notes that there are two ways to examine the industry’s break-even levels. The first is to calculate how much it costs to lift barrels companies have already drilled. The second relates to vertical-well oil production.

“I think most people would argue the range of how much it costs to lift a barrel out of the ground profitably is anywhere from $15 to $60,” Ferrari told The Epoch Times.

He noted that his firm can lift Bakken barrels out of the ground profitably as low as $20 and “potentially even lower.”

“My view is,” Ferrari added, “$55 is a really good number.”

Looking ahead to 2025, JPMorgan Chase Commodities Research analysts anticipate that oil prices could average $75 per barrel in 2025 and fall to $60 by the end of next year.

The Energy Information Administration’s (EIA) latest Short-Term Energy Outlook projects that prices will average $78 in 2025.

“He’s a smart guy, and I think he says things very simply at times, but he knows that we need a price point of $55 to $60 or $65 to be able to justify producing more drills in the U.S., and he doesn’t want to cripple our industry,” Ferrari said.

Seeing Green From All of the Above

In the aftermath of Election Day results, a plethora of renewable-energy stocks tanked, from First Solar (negative 14 percent) to Sunrun (negative 18 percent.

The sell-off has been fueled by growing expectations that Trump could eliminate or curtail various government subsidies in the Inflation Reduction Act.

According to the International Energy Agency (IEA), domestic renewable energy expansion has been projected to double from 2024 to 2030, “propelled by generous Inflation Reduction Act (IRA) stimulus in the form of tax incentives.”

Trump’s second term will stall momentum for the clean energy transition, says Dan Lashof, the U.S. director of the World Resources Institute.

“Donald Trump heading back to the White House won’t be a death knell to the clean energy transition that has rapidly picked up pace these last four years,” Lashof said in a post-election statement.

“President Trump will face a bipartisan wall of opposition if he attempts to rip away clean energy incentives now.”

While there is concern that the future of the renewables sector might be up in the air in a second Trump term, using a “scalpel” rather than a “sledgehammer” to the massive number of subsidies might be more realistic, says House Speaker Mike Johnson (R-La.)

In September, Johnson accepted that it would be almost impossible to “blow up” much of Biden’s signature climate change legislation.

“You’ve got to use a scalpel and not a sledgehammer, because there’s a few provisions in there that have helped overall,” Johnson said in an interview with CNBC in September.

A chorus of Republican lawmakers penned a letter to Johnson, urging the GOP leadership to preserve some provisions in the bill.

“Prematurely repealing energy tax credits, particularly those which were used to justify investments that already broke ground, would undermine private investments and stop development that is already ongoing,” 18 Republicans wrote in the August letter. “A full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.”

Despite the president-elect’s antagonistic views toward green energy, Adam Ennamli, the chief risk officer at General Bank of Canada, does not believe a Trump presidency “would signify the end of the renewable energy sector.”

“The industry has matured significantly and is now largely driven by economic factors rather than solely by federal policy,” Ennamli told The Epoch Times. “While Trump’s administration may roll back certain regulations and subsidies, the fundamental market dynamics favoring renewables are robust.”

In addition, notes Ennamli, the renewable energy sector had prepared for different political outcomes by concentrating on state-level markets, expanding new private financing structures, utilizing storage solutions, and diversifying supply chains.

“While a second Trump term may present challenges for the renewable energy sector through regulatory rollbacks and reduced federal support, it is unlikely to halt its growth, viability, or value promise,” he added. “The industry’s maturity, driven by economic fundamentals and state-level initiatives, positions it well to adapt and thrive even amidst political shifts.”

With two months to go, there has been speculation that the White House could distribute the remaining Inflation Reduction Act grant funds ahead of Inauguration Day.

Trump has pledged to cancel all unspent funds from the Inflation Reduction Act. However, even if Trump were to roll back many IRA tax credits, grants, and other subsidies, much of the funding has already been deployed.

So far, the administration has awarded $90 billion in grants to climate and clean energy projects, accounting for about three-quarters of the bill’s grant funding.

Neil Winward, the CEO at Dakota Ridge Capital, believes a more likely scenario is triggering a congressional review.

As part of the Congressional Review Act, Congress has the power to review and potentially overturn new final federal regulations imposed by government agencies and

“I think one of the things that an incoming administration has the ability to do is to freeze regulations within some windows of time,” Winward said to The Epoch Times. “It gives them 60 days to completely obliterate an entire regulation, a very blunt instrument.”

A more likely scenario, experts believe, is that the incoming administration would adopt an all of the above approach to energy policy, embracing a diverse array of fuel sources to bring down prices and assert America’s dominance in the global economy.

“A Trump administration has to be promoting all the above energy forms because the only thing that really digs out of the economic issues that we’re facing with the debt burden that we have is something of an energy miracle,” Winward said.

The United States will likely need to employ various energy sources as power demand is projected to reach record highs in 2024 and 2025, according to the EIA.

From The Epoch Times