A former executive and manager of a data broker company were found guilty of wire fraud and mail fraud, targeting elderly Americans and stealing potentially over $120 million.

After a two-week trial, Robert Reger, 57, of Boulder, Colorado, and David Lytle, 64, of Leawood, Kansas, employees of data broker Epsilon Data Management, were found guilty of wire fraud and mail fraud, according to a Department of Justice press release.

The two men exploited their positions and access to data in the data broker company Epsilon and sold elderly and vulnerable people’s home addresses to fraud perpetrators, with the number of targeted people at their disposal reaching 100 million households.

The fraud scheme has been running for ten years, with the direct fraud perpetrators—Mr. Reger and Mr. Lytle’s buyers—sending false and deceptive mail to elderly people, many of whom became victims and sent back checks, losing more than $120 million, according to the DOJ.

The bait for the elderly was money, either that they would win a big cash prize if they forwarded a check or emails telling them that, based on their astrological signs, they were going to become wealthy.

Mr. Reger worked for Epsilon from 2005 to 2017 and led sales teams until forming and leading the sales unit that perpetrated the fraud. His position was vice president of the “Direct to consumer” unit. According to the court, he was knowingly involved in the scheme.

Mr. Lytle worked for Epsilon from 2012 to 2018 as a business development manager, recruiting people for the “Direct to consumer” unit of his co-conspirator.

The two face a maximum penalty of 20 years in prison for each count.

Another Epsilon vice president pleaded guilty in 2018 to participating in the same scheme. Epsilon paid $150 million to settle this, of which $122 million was returned to victims.

Mr. Reger and Mr. Lytle used Epsilon transactional data collected from marketing clients to predict new “responsive buyers,” with the help of the company’s algorithms, according to the DOJ press release.

In one case, the two criminals sold 100 lists to one of their direct perpetrator clients.

At trial, elderly victims and their adult children testified about the scam letters that victims received, falsely promising cash prizes.

“This case serves as a warning” for authorities to hold “corporate executives accountable for fraudulent use of consumer data,” said Principal Deputy Assistant Attorney General Brian M. Boynton. “We will investigate and prosecute individuals who use sophisticated technology to defraud consumers.”

Attorney Cole Finegan for the District of Colorado said, “Defrauding elderly and vulnerable consumers will not be tolerated in the State of Colorado. This case is an example of the responsibility both executives and companies hold when it comes to gathering and selling personal data, and I hope other companies take note of the serious outcomes of this case.”

U.S. Postal Inspection Service (USPIS) Inspector Eric Shen said, “The USPIS sees the conviction of these individuals as a significant victory in our ongoing efforts to protect older adults from fraud and exploitation.”

Fraud Crisis

Elderly and younger Americans are also scammed by phone calls, and the money stolen annually exceeds billions of dollars. For example, a criminal call may say that a close family member was arrested and that a “bail bondsman” will arrive to collect several thousand dollars.

The perpetrator says that the money will be returned and that a “gag order” is in place so the victim should not speak to others, according to the DOJ.

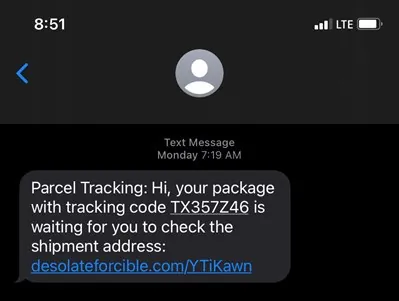

Robocalls, text messages with fake links asking for passwords, and live phone calls are all used to deceive vulnerable populations or individuals.

The Federal Trade Commission received 1.2 million complaints about robocalls in fiscal year 2023.

In 2022, adults older than 60 reported more than 88,000 complaints to the FBI’s Internet Crime Complaint Center (IC3), with losses totaling more than $3.1 billion—an 84 percent increase compared to 2021, the FBI reported.

Victims ages 50 to 59 reported losses totaling a little more than $1.8 billion, and nearly 95,000 victims ages 30 to 39 reported more than $1.2 billion in losses.

A separate report by the American Association of Retired Persons, which included data from more agencies, found that elder financial exploitation costs victims ages 60 and older more than $28.3 billion, annually.

A fake text on the phone may say that there was suspicious activity in a victim’s account (such as Amazon) and that the account will be closed, unless the victim gives his or her passwords to a fake website, linked at the end.

People who are in a hurry, or elderly who are not used to recognize how legitimate a link looks, might be deceived.

Cybercriminals can pretend to be from the government, a family member, or a friend, or a potential love interest, “especially now that they have generative Artificial Intelligence at their disposal,” Ally Armeson, from the Cybercrime Support Network said.

For younger ages, such as 18 to 24, the most dangerous are employment scams, followed by online purchase scams, and cryptocurrency scams.

Katie Spence contributed to this report.