Scammers have stolen more than $1.03 trillion globally in the past 12 months, a figure comparable to some nations’ GDPs, according to a new report.

The 2024 Global State of Scams report, released by the Global Anti-Scam Alliance (GASA) in partnership with Feedzai, sheds light on the widespread impact of scams.

The study, based on responses from more than 58,000 people worldwide, outlines the economic and emotional toll scams have had on consumers.

According to the report, nearly half of all global consumers face scam attempts at least once a week.

“Very little has changed in the last 12 months, as the world’s consumers bear the weight of another $1.03 trillion stolen by scammers,” said Jorij Abraham, managing director of GASA.

“We must do more to combat these crimes, as they continue to erode trust in our systems and cause immense harm to individuals and economies.”

Regional Differences

The report found regional differences in how consumers are exposed to scams. Countries like Brazil, Hong Kong, and South Korea face near-daily scam attempts, while Vietnam, Saudi Arabia, and China have seen a notable decrease in scams, possibly due to local preventative efforts.

Certain regions were found to report higher scam rates and losses. Shopping scams dominate in Kenya and Nigeria. Investment scams are also rampant in Nigeria.

South Korea and Vietnam report the lowest levels of online shopping scams.

Meanwhile, identity theft remains a significant concern in Australia and Mexico, with both countries showing a 25 percent victimization rate.

The report also analyzed how financial losses from scams affect nations, with less developed ones suffering more.

In developed countries, the dollar amount of losses per victim was much greater, especially in the United States, Denmark, and Switzerland, with Americans averaging a $3,530 loss.

Conversely, less developed countries suffered more significant economic harm, with Pakistan suffering scam losses equal to 4.2 percent of its GDP. Kenya and South Africa also reported significant GDP impacts of 3.6 percent and 3.4 percent, respectively.

Rise of AI in Scam Tactics

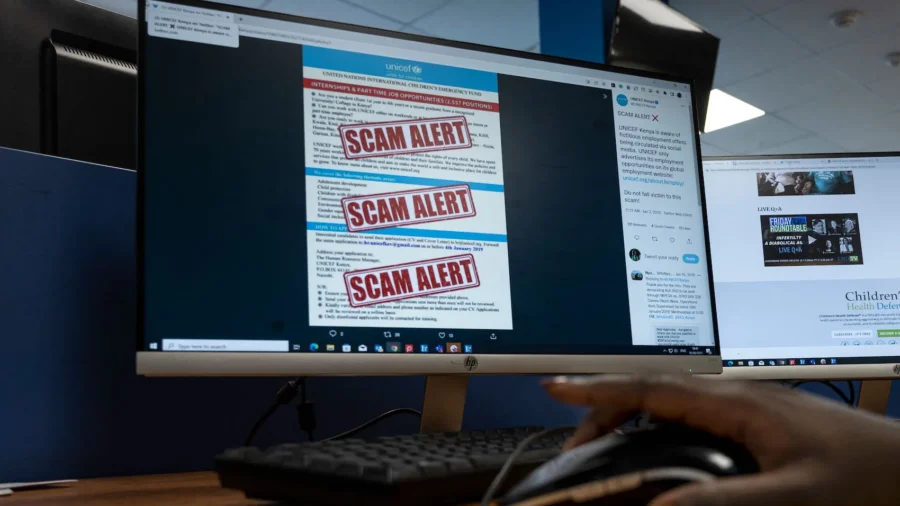

According to the report, the rise of artificial intelligence (AI) in scam tactics is a growing concern, but only 31 percent of survey respondents knew of AI’s possible role in such illegal activities.

The report raised concerns over generative AI, which researchers say has become a dangerous tool for fraudsters due to its ability to reproduce and scale tactics.

However, simple phone calls and text messages remain the most common scam tools. WhatsApp, Instagram, and Gmail are also commonly used. SMS scams are more prevalent in the Philippines, South Korea, and Brazil, while WhatsApp scams are on the rise around the world.

Beyond financial losses, the study found that scams have also harmed victims emotionally. Feelings of vulnerability, fear, and loss of trust are common, with Kenya, the Philippines, and South Africa reporting the highest emotional tolls for those who have fallen victim to a scam. Japan and South Korea have lower emotional impacts, potentially due to cultural differences.

Scam Spotters

Crediting awareness initiatives, the report highlighted that 67 percent of people worldwide now feel confident they can detect scams. China (84 percent) and Australia (72 percent) lead in scam-detection confidence.

Nuno Sebastião, co-founder and CEO of Feedzai, commended the growing awareness.

“Consumers are becoming smarter at catching scams themselves. This year, 67 percent of respondents expressed confidence they could spot a scam. This strong display of confidence is a testament to banks’ and others’ efforts to educate consumers on the red flags to watch for that could be a scam,” he said.

However, a key finding in the report is how few scam victims successfully recover their lost funds. Only 4 percent of scam victims worldwide are successful in getting back what was stolen. The United States and the U.K. reported the highest recovery rates.

Banks, Payment Providers

Sebastião said banks and payment providers play the largest roles in the last stage of a scam, and regulators handle the issue differently regionally.

“Banks and payment providers are at the final stage of the scam lifecycle, where illicit attempts to extract money either succeed or fail. Significant differences exist across countries, including how regulators approach scam prevention, which complicates global efforts,” he said.

GASA and Feedzai have urged financial institutions, social media platforms, and telecom providers to collaborate to safeguard consumers, recommending standardized definitions and measurements of scams globally.

“A global organization such as GASA plays a crucial role in unifying scam prevention efforts,” Abraham said. “Increasing the amount of shared, secure data across industries is essential to improving scam controls and protecting consumers worldwide.”